Release Notes - December 2024

Release notes - XPay - December 2024

We’re excited to announce a series of significant updates and new features introduced to XPay this month. These enhancements are designed to improve efficiency, flexibility, and transparency for our users.

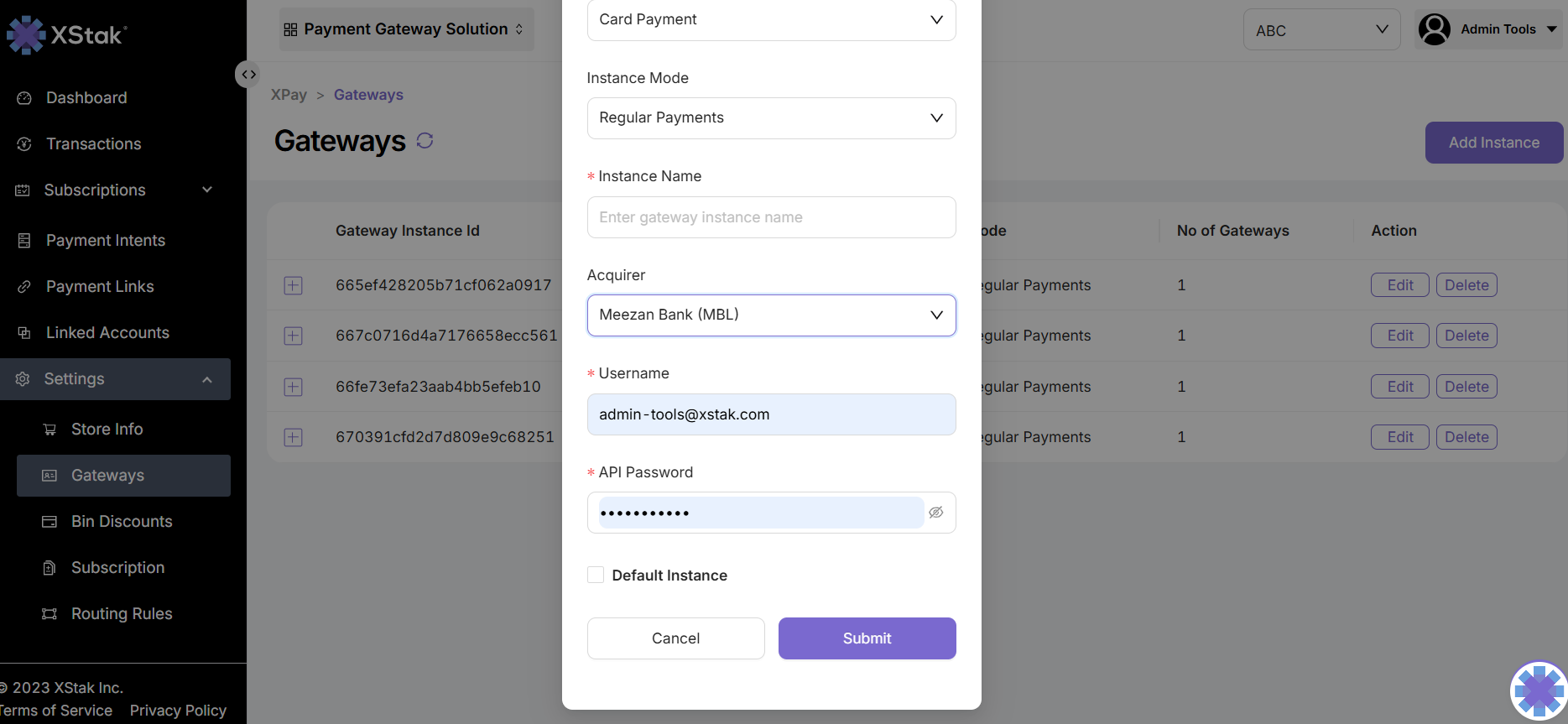

Meezan Integration

We are pleased to announce that XPay now supports Meezan Bank, one of the leading Islamic banks in the region. With this integration, merchants using Meezan Bank can seamlessly process their payments through XPay. Whether you’re already banking with Meezan or considering it as an option, this update allows you to handle transactions with speed and reliability. By adding Meezan Bank to our network, we continue to expand our support for diverse banking needs, giving merchants more flexibility and convenience in managing their payment solutions.

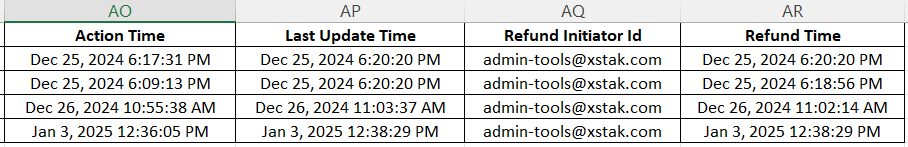

Refund ID in Transaction Export Files

Transparency and traceability are key when managing payments, and we’ve taken steps to improve both. The transaction export file now includes a Refund ID and Time of the refund for every refunded transaction. This will provide clear details on who processed the refund and the exact time it was performed.

This combination of information enhances accountability and simplifies the auditing process. Merchants can now review refund activities more comprehensively, ensuring both internal and external reporting needs are met with greater accuracy and detail. This feature adds another layer of clarity to your payment operations, empowering you to make informed decisions with confidence.

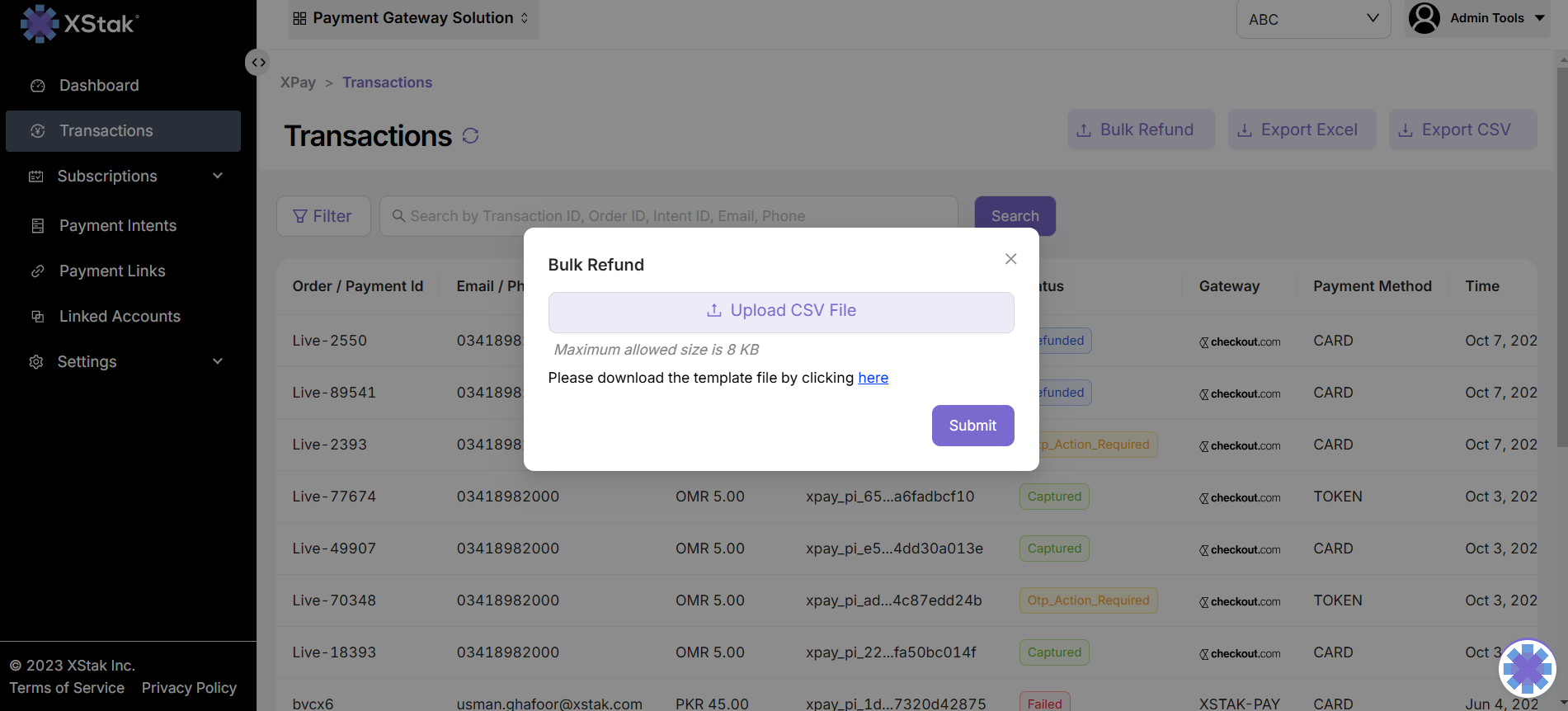

Bulk Upload for Payment Reversals/Refunds

Refund management has never been easier. With the introduction of bulk upload functionality for payment reversals and refunds, merchants can now process multiple refunds in a single action. This feature allows you to upload a file with refund details, eliminating the need to manually process refunds one transaction at a time. This update is particularly beneficial for high-volume merchants, enabling significant time savings and reducing operational overhead while ensuring accurate and efficient processing of refunds

Gateway-Agnostic Tokenization

We’re proud to introduce gateway-agnostic tokenization, a significant enhancement to both payment security and operational flexibility. This feature ensures that sensitive payment card data is tokenized securely, independent of any specific gateway, giving merchants the freedom to work with multiple payment providers or switch gateways without losing functionality or security.

A key aspect of this feature is its seamless handling of gateway transitions. If a merchant previously operated with one gateway where user tokens were created and then decided to switch to another gateway, users will simply need to re-add their card details under the new gateway. Once added, token will be updated and enabled on the new gateway as well. This approach ensures merchants can migrate between gateways with minimal disruption to user experience while adhering to the strictest data protection standards.

By offering secure token portability and simplifying gateway transitions, gateway-agnostic tokenization empowers merchants to adapt their payment infrastructure as needed without disrupting the user experience or compromising security.

These updates reflect our commitment to delivering a dynamic and secure payment platform that evolves with the needs of our merchants. Whether it’s simplifying processes, expanding compatibility, or prioritizing security, we’re here to help you succeed.

Thank you for trusting XPay. Here’s to a year of growth, innovation, and shared success in 2025!

Milestones - Checklists

Fraud Rules Engine

Easypaisa Integration

Note: This is the tentative due date for the milestone features, a minor delay can be faced, but only these feature(s) can be expected to go live in the coming month.

Please stay tuned for some exciting new features coming soon next month!